Sustainable Wealth for a Volatile World: Strategies for Navigating Market Uncertainty

4.9 out of 5

| Language | : | English |

| File size | : | 2322 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

| Lending | : | Enabled |

In the ever-changing landscape of global markets, achieving sustainable wealth is a challenge that requires careful planning and a keen understanding of the factors that drive financial success. Volatility and uncertainty have become defining characteristics of the modern economic environment, making it crucial for investors to adopt strategies that can withstand market fluctuations and preserve long-term value.

Understanding the Impact of Volatility

Market volatility, characterized by sharp price swings and unpredictable fluctuations, can have a significant impact on investment portfolios. When markets experience downturns, asset values can depreciate rapidly, leading to substantial losses for investors. Conversely, periods of market upswing can lead to significant gains, but these can be equally susceptible to reversals.

The unpredictable nature of volatility makes it challenging to predict market movements accurately. However, recognizing the potential risks and benefits associated with volatility is essential for developing a sound investment strategy.

Strategies for Sustainable Wealth

To build sustainable wealth in the face of market volatility, investors should consider the following strategies:

1. Portfolio Diversification

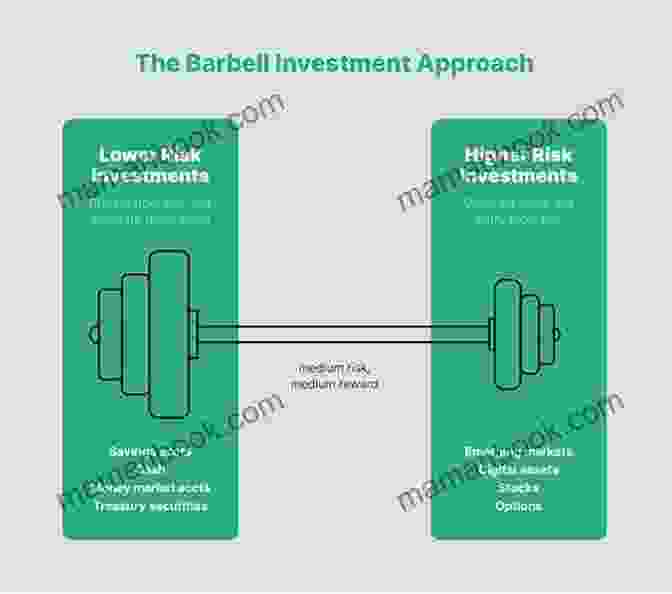

Diversifying an investment portfolio across different asset classes and investment vehicles reduces risk and enhances long-term returns. By spreading investments across stocks, bonds, real estate, and alternative assets, investors can mitigate the impact of market downturns and capitalize on growth opportunities in various sectors.

2. Long-Term Planning

Adopting a long-term investment horizon helps investors weather market fluctuations and achieve financial goals. By investing with a time horizon of years or even decades, investors can ride out short-term market volatility and benefit from the compounding effects of interest and capital appreciation.

3. Risk Management

Effective risk management is crucial for preserving wealth during periods of market turbulence. Investors should assess their risk tolerance and invest accordingly. Utilizing stop-loss orders, hedging strategies, and asset allocation models can help limit losses and protect capital.

4. Asset Allocation

Asset allocation involves dividing an investment portfolio among different asset classes based on the investor's risk tolerance, time horizon, and financial goals. A well-balanced asset allocation strategy can optimize returns while mitigating risks.

5. Regular Reviews and Adjustments

Investment portfolios require regular reviews and adjustments to ensure alignment with changing market conditions and financial objectives. Monitoring performance, rebalancing asset allocations, and adjusting risk exposure as needed helps maintain sustainability and maximize returns.

Economic Resilience and Financial Independence

In addition to these strategies, investors should also consider factors that contribute to economic resilience and financial independence. These include:

1. Multiple Income Sources

Diversifying income streams reduces reliance on a single source of earnings. Developing passive income sources, such as rental properties or dividend-paying stocks, provides financial stability during economic downturns.

2. Emergency Fund

Maintaining an emergency fund with liquid assets equivalent to several months' living expenses provides a financial cushion during unexpected events or periods of unemployment.

3. Education and Financial Literacy

Continuously expanding financial knowledge and staying informed about market trends enables investors to make informed decisions and navigate market volatility effectively.

Sustainable wealth in a volatile world requires a holistic approach that addresses market fluctuations, risk management, and long-term financial planning. By embracing diversification, adopting a long-term perspective, implementing risk mitigation strategies, and fostering economic resilience, investors can navigate market uncertainty and achieve financial success. Remember, the journey to sustainable wealth is not without challenges, but with careful planning and a commitment to sound investment principles, investors can build a solid financial foundation that withstands the test of time.

4.9 out of 5

| Language | : | English |

| File size | : | 2322 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Logo Daedalus

Logo Daedalus Jenna Austin

Jenna Austin Dr Edward Joseph

Dr Edward Joseph Samuel Pepys

Samuel Pepys Natalia Long

Natalia Long James Weldon Johnson

James Weldon Johnson Laura Hunter Lpn

Laura Hunter Lpn Sheila Lamb

Sheila Lamb Sarah Ockwell Smith

Sarah Ockwell Smith Marcus Garvey

Marcus Garvey Douglas Murray

Douglas Murray Sarah Elisabeth Sawyer

Sarah Elisabeth Sawyer Monica Eriksson

Monica Eriksson Ethan Coen

Ethan Coen Rachael Thomas M S Ed

Rachael Thomas M S Ed Jamilexis Gallardo

Jamilexis Gallardo Nadia Eghbal

Nadia Eghbal Mike Blake

Mike Blake Yarelis Gandul Cabrera

Yarelis Gandul Cabrera Jennifer L Goeke

Jennifer L Goeke

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Branson CarterFollow ·2.4k

Branson CarterFollow ·2.4k Denzel HayesFollow ·4k

Denzel HayesFollow ·4k Carter HayesFollow ·10.8k

Carter HayesFollow ·10.8k Ivan TurgenevFollow ·3.5k

Ivan TurgenevFollow ·3.5k Jules VerneFollow ·3.6k

Jules VerneFollow ·3.6k David MitchellFollow ·7.6k

David MitchellFollow ·7.6k Alan TurnerFollow ·6.4k

Alan TurnerFollow ·6.4k Dakota PowellFollow ·6.1k

Dakota PowellFollow ·6.1k

Ernest Powell

Ernest PowellBenefits of Corporal Punishment: A Review of the...

Corporal punishment is a form of physical...

Bobby Howard

Bobby HowardThe Development and Significance of African American...

African American...

Guy Powell

Guy PowellDown Girl: The Logic of Misogyny - A Comprehensive...

In her groundbreaking work,...

Forrest Blair

Forrest BlairThe Bikini Changing Room: A Micro Mini Romance

In the heart of...

4.9 out of 5

| Language | : | English |

| File size | : | 2322 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 271 pages |

| Lending | : | Enabled |